AMERICAN INTERNATIONAL TAX ADVISERS

ASIA’S BEST U.S TAX FIRM

New Thai Tax Regulations explained right here...

Thomas Carden sits down with YouTuber Jett Gunther to explain.

ABOUT US

Who we are

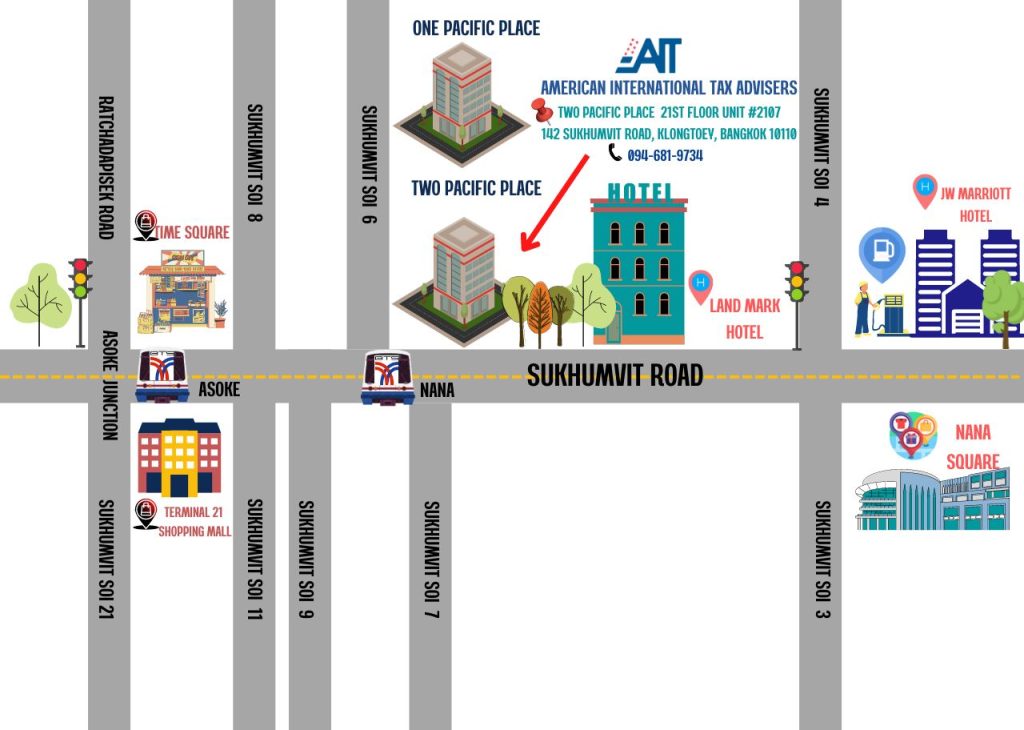

American International Tax Advisers is Asia’s best U.S. tax firm. We are focused on assisting U.S. expatriates and businesses with tax planning, consulting and return preparation. We serve clients across Asia, Australia, Brazil and the U.S. from offices in various countries, such as Bangkok Thailand, Hong Kong, Manila Philippines, Phnom Penh Cambodia, Kuala Lumpur Malaysia, Jakarta Indonesia, Taipei Taiwan, United Arab Emirates, Saudi Arabia, Sydney Australia, Sao Paulo Brazil and Sarasota Florida.

Individual

We handle a variety of services for expatriates living in Asia, from filing normal U.S returns to tougher cases. We are experts in preparation of the current returns as well as correctly completing past due returns for U.S. Citizens and Green Card holders including file Foreign Bank Account Reports (FBAR). We can help you plan your tax to minimize your tax paying.

Business

We are specialists in international tax planning and structure for companies where there is a connection with the USA, such as incorporating in the US. We can provide high level planning and compliance services, such as fiduciaries, transfer pricing, and trust. We also help clients file W-8Ben and W-8Ben-E forms to declare their tax status of Non-U.S. Citizens or Non-U.S. Businesses or Foreign Businesses.

Testimonials

What Our Customers Are Saying

“Delivered on everything that they said they would. Recovered tax overpayment...many thanks again.”

David Cull